about us

Who we are

We are a regulated investment services firm, offering independent advisory, pioneer operational outsourcing services in the primary debt market, as well as intermediation and brokerage services in capital markets. This division of PKF Attest was established in 2014 to advise clients on their debt capital market activities.

Our aim is to help our clients obtain efficient funding via the debt capital markets. We have developed a unique primary debt market issuance service that supports and helps companies who rarely appear on the debt capital markets to take full advantage of the efficiency of wholesale funding, just as frequent issuers do, but without having to put in place the additional resources normally associated with it. We leverage on synergies, helping clients reduce their funding cost and increase their operational efficiency.

We are a market reference firm for Commercial Paper and bonds, operating in the European market through standard ECP/EMTN formats and in domestic markets through domestic CP & bonds formats. We help our investors obtain the best short and long-term investment opportunities, in the primary and the secondary fixed-income markets.

We provide valuation and liquidity services in the secondary market, identifying and executing the best opportunities for our clients. Furthermore, we promote sustainable financing, implementing ICMA’s Green and Sustainability-Linked Principles.

The Team

Our team is led by reputable, highly experienced professionals with broad corporate and investment banking backgrounds and a long history of working together. We combine profound knowhow and extensive experience in primary debt issuance, bonds and commercial paper origination and distribution, syndicated loans, bank financing, securitizations, project and structured finance.

Jokin Cantera

Partner

Javier Jordán

Partner

Wafi Saleh

Partner

Ander Landeta

Leticia Erasun

Sofía Compostizo

Sarai Maza

Sandra Álvarez

Irene Mendivil

Jesús Rodríguez

Belén Vicario

Endika Martínez

Soledad Cuenca

José Gonzaga

Sofía Jacob

Josu Díez

Julia Castelló

Lucas Cortazar

Juan Manso

product engineer

Our IT partners

Sonia Roncero

product engineer

Manuel Jesús Gil

Javier Jordan

Our Values

partnership approach

We believe in long-term relationships and work under a partnership approach with our clients. We act in our client’s best interest and strive to be their trusted partner in all their capital markets activities. We dedicate our efforts and resources to providing our clients with a value-added service, anticipating their needs and requirements, knowing that their success will assure our own.

independence

We believe that our independence is an asset, which guarantees our clients a superior, best-in-class service. Our service is 100% free from conflict of interest and is neither influenced nor compromised by competing business lines. We are reliable and loyal towards the client rather than the transaction.

teamwork

Our people are our prime asset. We build trust and teamwork through open, and truthful communication. We share ideas and best practices, and promote our team’s personal and professional growth. We believe that teamwork brings the highest value to our clients.

innovation

With a clear view of the capital markets and an adaptable dynamic structure, we develop creative business solutions that provide value and create new opportunities for our clients. We invest in technology and develop solutions that makes primary market issuance a simpler and smother process.

integrity

We share our goals, ideas and experience directly and openly with our clients, ensuring consistency between our values and our actions.

passion

We seek progress. We are committed to surpassing our clients’ expectations, through responsibility, proactivity, creativity and the pursuit of excellence, giving the best advice and building a true long-term relationship.

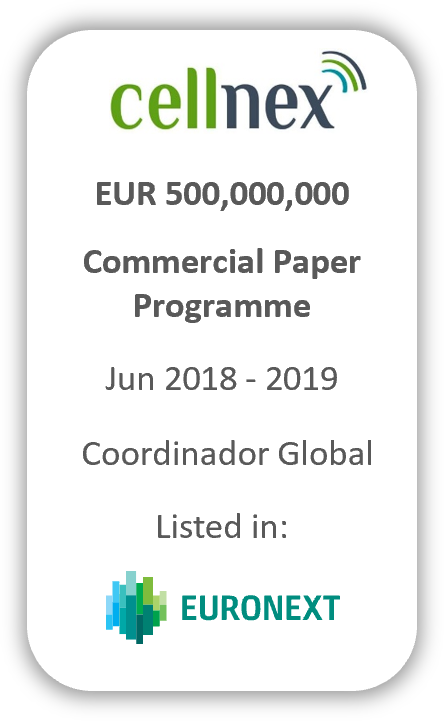

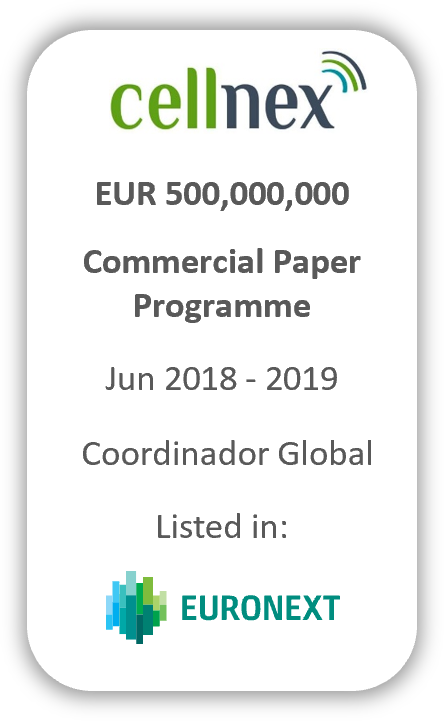

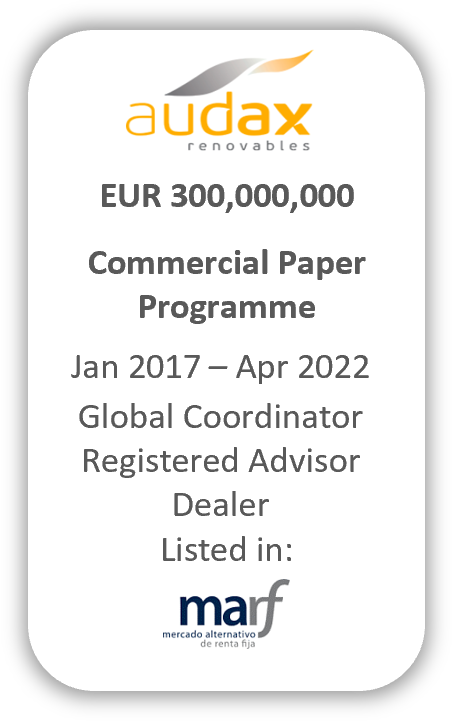

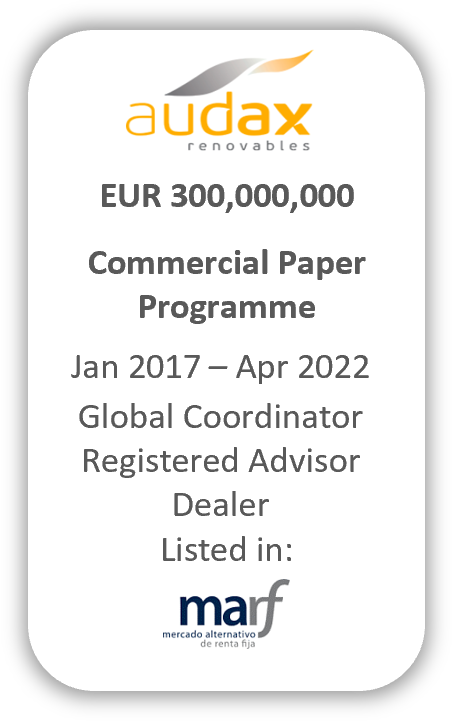

References

Short Term

Long Term

Debt programmes currently managed by PKF Attest DCM

Bond Transactions

Other programmes established by PKF Attest DCM